ESG, TCFD and Climate Service

ESG stands for environmental, social and governance and refers to a set of standards used to measure an organization’s environmental and social impact, which are the core measures of investment sustainability.

The traditional approach to evaluating enterprises primarily revolves around the company's financial metrics, encompassing revenue and profit generation, profitability ratios, cash flow dynamics, as well as its debt repayment capabilities. ESG investment has gained significant importance in fostering long-term sustainable returns through the study of non-financial indicators. It serves as a vital ‘demining’ tool in the investment landscape, where asset managers are increasingly recognizing the significance of non-financial metrics in investment decisions. ESG investment is instrumental in identifying risk events within enterprises and companies, thus promoting their sustainable development. With the proposal of China's ‘dual carbon’ goal in 2020, the popularity of ESG in the domestic market has surged. Gradually, ESG is becoming a mainstream consideration, evidenced by nearly 300 A-share listed companies releasing their 2022 ESG reports.

Figure 1. The ESG framework

TCFD: Task Force on Climate-related Financial Disclosures

In December 2015, the Financial Stability Board (FSB), consisting of G20 members, established the Task Force on Climate-related Financial Disclosures (TCFD for short). In June 2017, the Task Force released its first official report, namely the Guidelines for Climate-related Financial Disclosures (TCFD) (Reference website: https://www.fsb-tcfd.org/). Since then, it has been issuing annual progress reports. Currently, TCFD is the most influential and widely supported climate information disclosure standard globally, which not only promotes institutional consistency among G20 member countries but also provides a common framework for the disclosure of climate-related financial information. The climate-related data disclosure framework provided by TCFD for financial institutions and enterprises has been recognized by global regulators and capital markets.

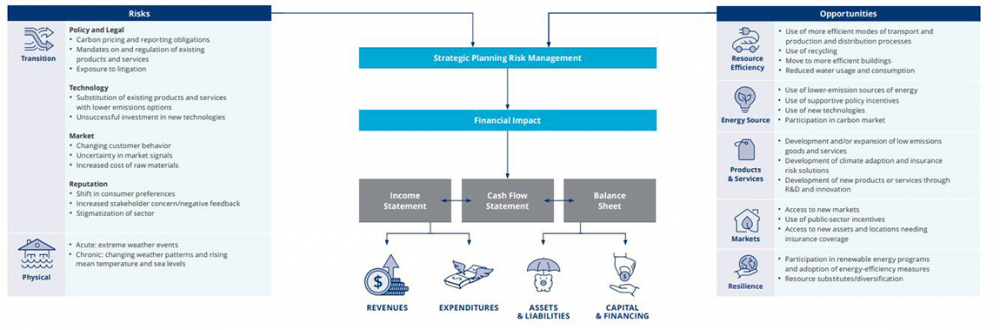

Figure 2. Climate-related risks and opportunities

Since 2021, an increasing number of Chinese institutions have researched and formulated ‘dual carbon’ work plans based on the TCFD framework, clarifying green and low-carbon strategies, improving corporate governance, incorporating climate risks into the comprehensive risk management system, gradually optimizing investment and financing structures, and conducting in-depth exploration and practice in promoting green and low-carbon transformation. By 2022, more than 20 Chinese enterprises (including Taiwan and Hong Kong) in the business and professional services category had disclosed information in accordance with the TCFD framework.

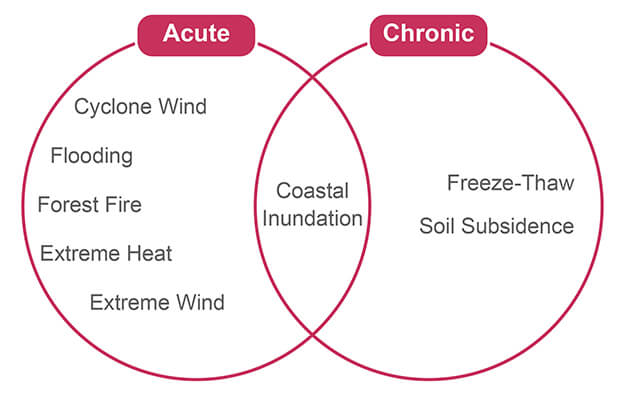

The necessity and urgency of climate-related risk disclosure

On the one hand, China is highly sensitive to climate change. In the future, the trend of extreme temperature and precipitation will become more frequently, and there will be significant changes in the timing, intensity, frequency, and regional characteristics of extreme disasters such as heatwaves, rainstorms, floods, and droughts under the condition of high climate variability. On the other hand, China attaches great importance to green, low-carbon, environmental protection, and sustainable energy development, and has issued a series of relevant policies to guide the transformation of production and consumption patterns in enterprises and society.

At the industry and enterprise level, the core task of ESG and TCFD disclosure is to accurately and reasonably identify, assess, quantify, monitor, manage, and disclose climate-related risks. Therefore, it is not only a framework for corporate information disclosure, but also a management tool for corporate climate risks. Implementing high-quality ESG and climate-related risk disclosure will significantly enhance the management level, market competitiveness, intangible asset brand value, financial stability, and social responsibility of industries and enterprises.

National Climate Center Capacity

(1) Professional, accurate and abundant data:

Climate Facts: High resolution observation data, remote sensing observation data, and reanalysis data.

Forecast and Prediction: High-precision climate prediction numerical models, high-resolution scenario prediction products (SSP).

Disasters and Risks: Long-term historical disaster data, national multi-disaster survey products, extreme event index products.

Socio-economic and Geographic Data.

Carbon Source and Sink Data.

(2) Scientific and reliable methods:

Physical risk assessment: The basic idea is to transform climate risks into measurable ‘financial figures. Starting from the impacts of climate change, it analyzes the extent of exposure of assets and other investment targets to risks. Then, it analyzes the decline in financial performance indicators of organizations along the micro and macro transmission channels, thus achieving the quantification of financial risks.

Figure 3. Physical risk assessment

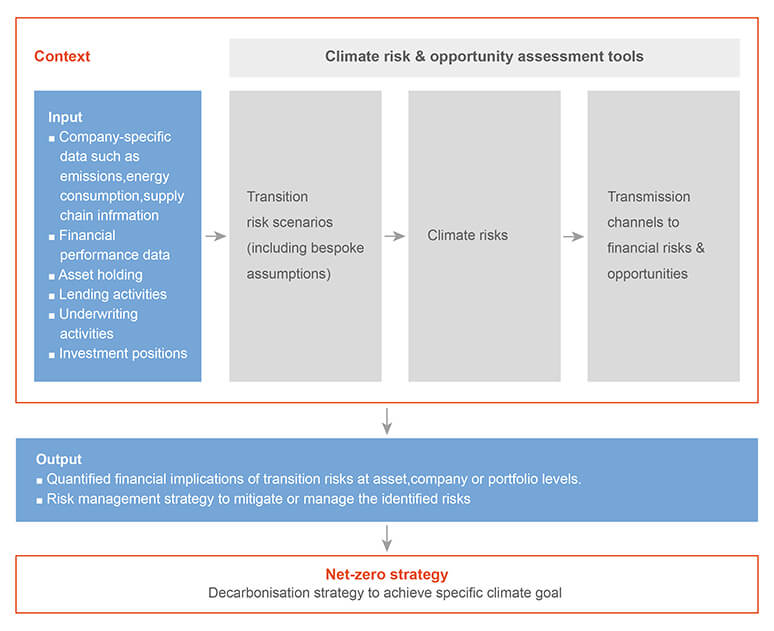

Transition risk assessment: Firstly, the work needs to estimate the impact of transition factors on an organization's operating costs and revenue under different climate scenarios, including transition factors such as reduced market demand and rising carbon prices. Then, these financial changes are converted into changes in risk indicators, such as changes in corporate valuations and loan default rates.

Figure 4. Transformation risk assessment

Contact Us:

Friendly link

Links to GPC websites

Links to NMHSs in RA II

Copyright:© 2005 ~ 2023 Beijing Climate Centre. All rights reserved. Technical support: zhongyan

address:46 South Street, Zhongguancun, Haidian District, Beijing Zip code:100081

Today:07813/Total:33993540